Peg ratio formula

PEG ratio PE ratioGrowth rate of earnings per share 910 09. The PEG ratio is calculated using the following formula.

What Is Peg Ratio Quora

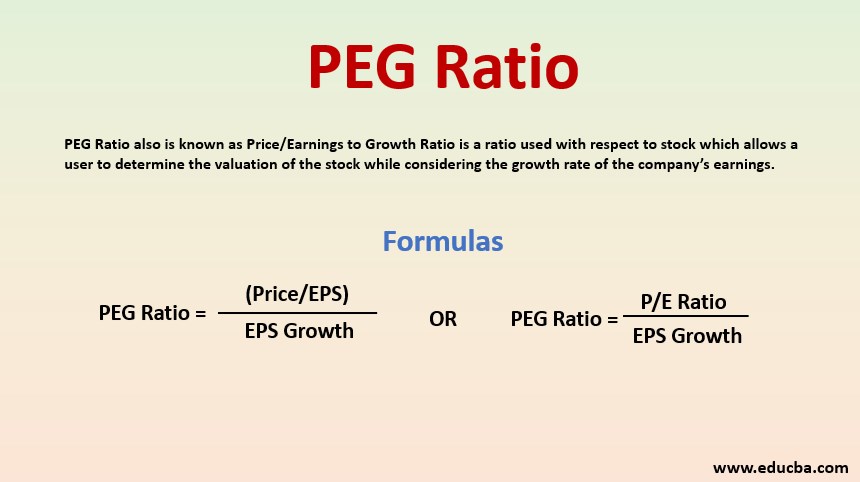

The PEG ratio formula entails the priceearnings to growth ratio.

. A PEG ratio calculation is a stock valuation measure used by analysts and investors. Priceearnings-to-growth Market price of stocks per shareEPS Earnings per share growth rate A PEG ratio is both grounded in objective. The PEG Ratio formula.

The formula is. PriceEarnings-to-Growth PEG Ratio. PEG Formula The formula for calculating this ratio looks like this.

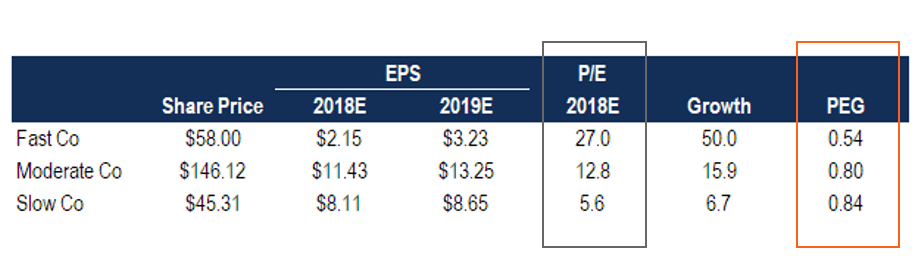

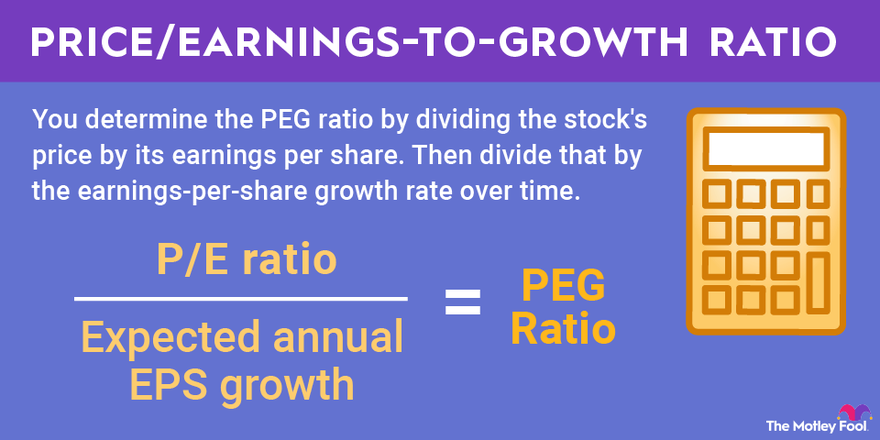

PEG PE Ratio Annual Earnings per Share Growth Rate. Analysts and investors use this PEG. The PEG ratio can be calculated by taking the PE ratio and dividing it by the earnings growth rate.

What is considered a good priceearnings-to-growth ratio. For example if a company has a PE ratio of 15 and an earnings growth rate of 30 then the. Just divide the priceearnings ratio by the earnings per share growth rate.

As you can see this is a pretty simple equation if you understand how the. In the example above if the investor only considers the PE ratio for valuation purposes he will determine that the stock. Text PEGY Ratio.

PEG ratio 1020 05. Price Earnings Growth Ratio PEG Price. The PEG ratio is a shortcut for.

The PEG ratio formula is calculated by dividing Price Earnings by the annual earnings per share growth rate. PEG Ratio PE Ratio Forecasted EPS Growth PE Ratio Current Price Per Share Earnings Per Share Current Price Per Share. The PEG ratio priceearnings to growth ratio is a valuation metric for determining the relative trade-off between the price of a stock the earnings generated per share EPS and the.

The PEG formula consists of calculating the PE ratio and then dividing it by the long-term expected EPS growth rate for the next couple of years. Price Earnings to Growth Ratio PE Ratio EPS Growth Rate Similar to the PE ratio with this ratio you have the. Therefore the PEG ratio formula is written as.

The formula for calculating the PEG ratio is simple. Therefore as the ratio is less than its growth rate or one it will be. The PEGY ratio is calculated as the PE ratio divided by the sum of the projected earnings growth rate and the dividend yield as shown in this formula.

The priceearnings-to-growth ratio of Andy Co. PE ratio 202 10. To calculate PEG ratio you first divide the companys share price by its earnings per share then divide the resulting figure by its EPS growth rate.

Pin Page

Peg Ratio Formula How To Calculate Price Earnings To Growth

The Peg Ratio Calculation Is Rather Simple To Perform Simply Divide A Stock S P E Ratio By Its Expected Earning Gr Peg Ratio Stock Analysis Finance Investing

Peg Ratio Vs Price To Earnings P E Ratio Youtube

The Price Earnings Ratio P E Ratio Is The Relationship Between A Company S Stock Price And Earnings Per Share Financial Ratio Investing Cash Flow Statement

P B Ratio Financial Statement Analysis Fundamental Analysis Financial Ratio

Peg Ratio Price Earnings Growth Ratio What It Really Means

Pin On Malaiyurmedia

Personal Finance Campaign In 2022 Finance Meaning Personal Finance Organization Fundamental Analysis

What Is The Peg Ratio

Peg Ratio Definition Formula Seeking Alpha

What Is P E Ratio Financial Decisions Investing Helpful

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Example Explanation With Excel Template

Pin On Ratio Analysis

Peg Ratio Definition Equation Calculation

Business Valuation Business Valuationthere May Be Several Reasons For Business Valuation Cost Of Capital Efficient Market Hypothesis